DFCC Bank Partners which have Home Countries Skyline to offer Smooth Property Money Choices

Monetary, societal and ecosystem development try seriously inserted in our philosophy and you may says to how we do business, produce services and products and you may send into all of our wants and you will obligations.

Mass media Eating plan

- Pr announcements

- Economic Press announcements

- Equipment Ads

- Video Podcasts

- Stuff

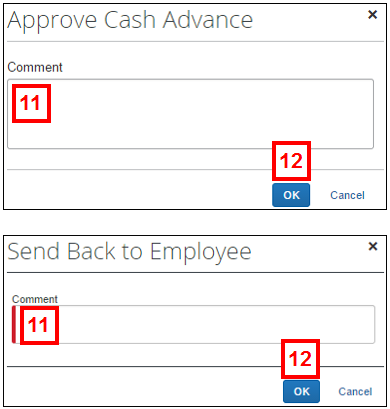

DFCC Bank has forged a personal relationship with Home Lands Skyline (Private) Limited, a move you to promises to revolutionise the fresh homes mortgage landscaping. It proper alliance, formalised compliment of good memorandum of knowledge (MOU) finalized into the 28th from , is set supply potential home purchasers and a home investors a number of pros. The latest signing service try enriched of the Aasiri Iddamalgoda Elderly Vp- Head from Merchandising Banking and you will SME, Asanka Patabadige Assistant Vice-president- Rental and you can Retail Investment Facts out of DFCC Lender, and you may Nalin Herath- Chairman/Controlling Movie director from home Lands Skyline.

DFCC Financial, a reliable seller out of home loans, features inserted forces which have Home Places Skyline giving a broad selection of construction financing packages. It strategic venture, geared towards taking smooth accessibility private investment options for users looking for domestic advancements by Family Places Skyline, is a beneficial testament to our commitment to and come up with owning a home a whole lot more much easier and you may attainable. Our casing loan packages is designed so you’re able to private need and have aggressive interest rates, flexible cost selection, and you will expedited processing minutes, guaranteeing a fuss-100 % free feel for potential home purchasers.

Posting comments towards the union, Aasiri Iddamalgoda Older Vp- Lead from Merchandising Banking and you may SME within DFCC Lender told you, Our company is thrilled to subscribe hands with House Places Skyline a respected CS 2 Rated designer to provide personal construction financing packages which can be aggressive and designed to fulfill this, personal need from consumers. (more…)