The amount of taxes is deducted from the net profit to arrive at the bottom line, i.E., The net profit after tax. Explore our online finance and accounting courses, which can teach you the key financial concepts you need to understand business performance and potential. To get a jumpstart on building your financial literacy, download our free Financial Terms Cheat Sheet. By understanding the intricacies of cost allocation, inventory valuation, and cash flow management, companies can better position themselves in a competitive marketplace. Manufacturing financial statements are more than just a requirement for regulatory compliance, they also hold hidden power. These statements offer invaluable insights that can shape strategic decisions, drive profitability, and enhance operational efficiency.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

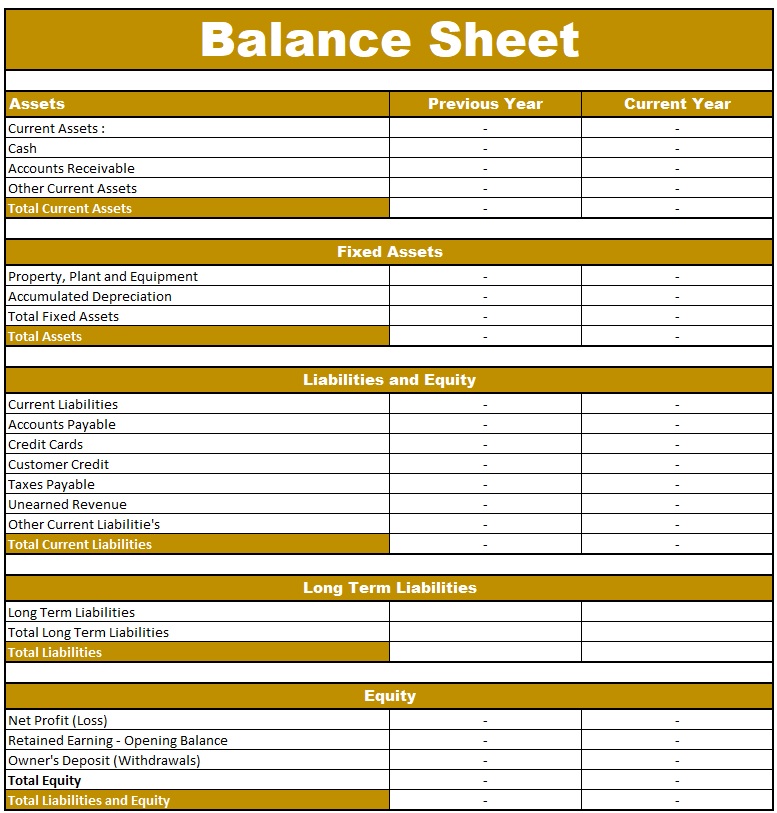

- For manufacturing firms, it includes inventory categorized as raw materials, work in progress, and finished goods.

- Here are five steps you can follow to create a basic balance sheet for your organization.

How to Prepare Income Statements for a Manufacturing Company

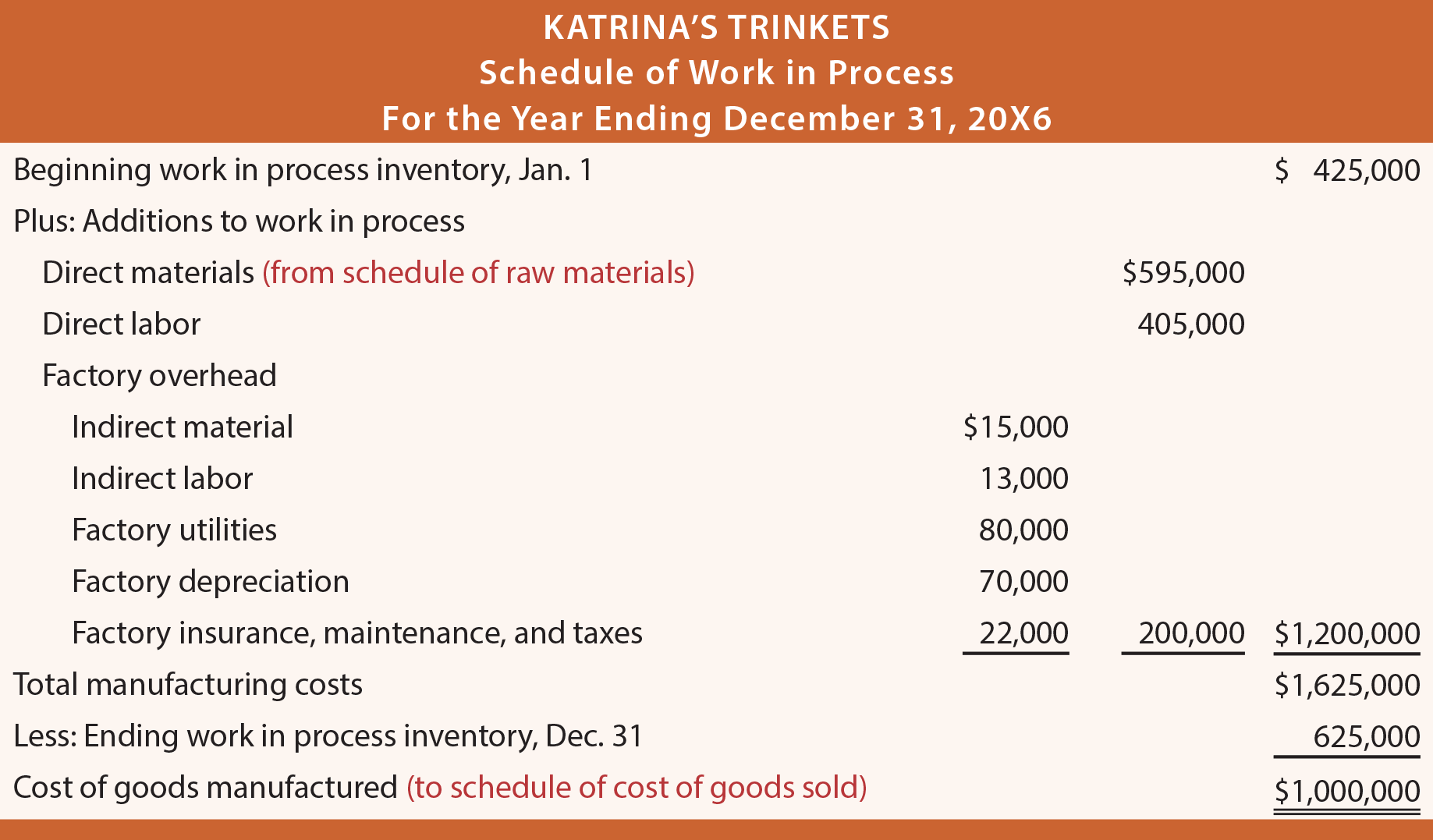

In contrast, inaccuracies in financial statements can lead to detrimental outcomes. This category includes the costs of goods that are still in the production phase. WIP accounts for the direct costs of raw materials, labor, and overhead involved in manufacturing.

How confident are you in your long term financial plan?

To resolve these issues, they implemented an integrated ERP system that automated critical processes and minimized data duplication. For manufacturers, this statement highlights sales revenue, COGS, and operating expenses, providing insight into profitability. By analyzing COGS, companies can determine their gross profit margin and evaluate the efficiency of their production processes.

Get in Touch With a Financial Advisor

If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Liabilities may also include an obligation to provide goods or services in the future. HashMicro is Singapore’s ERP solution provider with the most complete software suite for various industries, customizable to unique needs of any business.

Common Mistakes in Manufacturing Financial Statements

In report format, the balance sheet elements are presented vertically, i.e., the assets section is presented at the top, and the liabilities and owners equity sections are presented below the assets section. Some manufacturing companies prefer to transfer finished goods from the factory to the warehouse at an increased price, by adding a pre-set margin (called the manufacturing profit) to the production cost. This lecture will clarify how to prepare the income statement for a manufacturing company. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand.

Therefore, accurate tracking of direct labor is essential for reliable financial reporting. COGS represents the direct costs attributable to the production of goods sold by a manufacturing company. This includes costs of raw materials, direct labor involved in production, and manufacturing overhead. Manufacturing financial statements are vital tools that provide an in-depth view of a manufacturing company’s financial performance, specifically regarding the production process. A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day.

For example, a smartphone manufacturer might track components like LCD screens and nickel batteries. To accurately calculate raw material costs over a specified period, manufacturers must know how much was consumed in production. This level of detail introduces significant differences compared to financial statements from non-manufacturing sectors, such as retail or service companies. A bank statement is often used by parties outside of a company to gauge the company’s health. Our easy online enrollment form is free, and no special documentation is required. All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program.

Since manufacturing companies typically own a number of long-term assets, accumulated depreciation is often significant. Depreciation both acknowledges a long-term asset’s useful life and accounts for wear and tear. In addition, the use of depreciation is how a company moves a portion of an asset’s cost to the income statement from the balance sheet. Accumulated depreciation, which is the depreciation how does the tax exclusion for employer taken each year summed together, shows as a contra account to an asset, meaning it is subtracted from the asset’s original cost. Therefore, as short-term liabilities, manufacturing firms often show one or more lines of credit used to fund the purchase of raw materials and working capital. Working capital is the gap created by subtracting current liabilities from current assets.