My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. That’s why to gain a 360-degree view of a company’s efficiency, ROE must be viewed in conjunction with other factors, like ROA and ROI. Of course, nothing is ever equal when it comes to comparing different companies, even if they operate in the same industry and sector. It’s worth noting that investing comes with its share of risks, and you should always do your research, seek professional advice, and stay up-to-date with the latest market trends and news. By implementing practical strategies, you can improve your investment portfolio and boost your returns.

Using Return on Equity To Evaluate Stock Performance

Stocks almost always trade at a premium to the arbitrary par value recorded in the balance sheet. For most non-professional investors that’s impossible given all the other things going on in their lives. Yet any investor can benefit from looking at financial statements to find the key numbers for companies whose stocks they hold in their portfolio. A higher ROE indicates that a company is generating more profit with each dollar invested. However, understanding how it works and its benefits is crucial for you to make informed investment decisions. It is also essential to consider whether a company’s lower ROE is due to poor operational performance or is simply a reflection of the industry or market conditions.

What is strong ROE ratio?

ROE is a tool that allows you to measure a company’s profitability by examining the returns it generates on the money shareholders have invested. There are several ways a company can improve its ROCE, including increasing sales revenue, reducing expenses, and improving profitability. Additionally, a company can raise more capital from common stockholders or increase its borrowing capacity to invest in new projects or expand existing operations.

Impact of industry and economic factors on ROCE

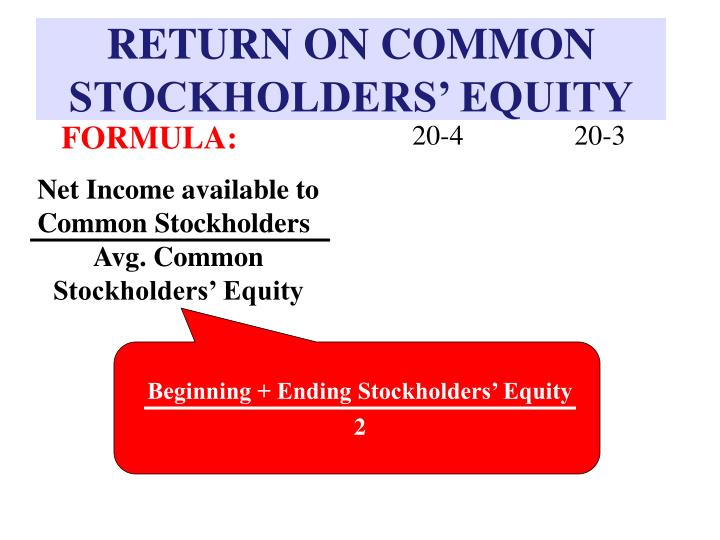

- To calculate the ROE, the net income of a firm is divided by the common shareholders’ equity.

- Generally, a company with high return on equity (ROE) is more successful in generating cash internally.

- The two companies have virtually identical financials, with the following shared operating values listed below.

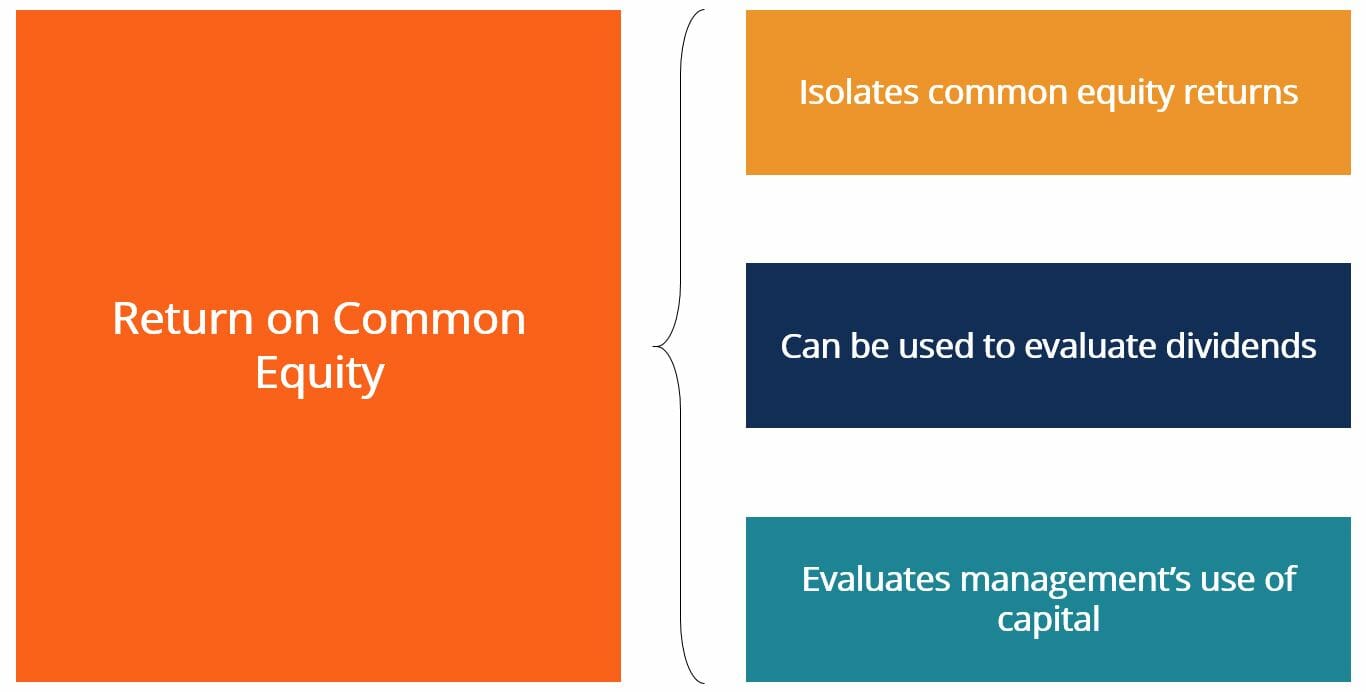

- Return on Common Equity (ROCE) is a key financial metric that measures the profitability and efficiency of a company by assessing the returns generated from its common shareholders’ equity.

A higher return on common equity ratio indicates that a company is generating higher profits from the net assets that have been invested by shareholders. Company C’s high ROCE indicates that it is efficiently utilizing its equity capital and generating a high return on investment. However, investors should consider the sustainability of this high ROCE and the impact of industry and economic factors on future performance. Investors may also analyze the trend of ROCE over the years and the impact of the company’s growth strategies on profitability. By comparing a public company’s net earnings to its shareholders’ equity stakes, ROE helps you understand how efficiently a firm is using its investors’ money to generate profits. In other words, ROE shows how much in profit the company earns from each dollar of shareholders’ equity, expressed as a percentage.

The denominator in the ROE calculation is now very small after many years of losses, which makes its ROE misleadingly high. Therefore, it’s crucial to evaluate a company’s debt levels and its ability to pay off its obligations. However, the differences that cause the ROE of the two companies to diverge are related to discretionary corporate decisions. Each year, net income is growing by $2m for both companies, so net income reaches $28m by the end of the forecast in Year 5.

How do I calculate ROE?

Companies with a higher return on equity (ROE) are far more likely to be profitable from the proper allocation of capital, but also because of the ability to raise capital from outside investors if needed. Over time, if the ROE of a company is steadily increasing, that is likely a positive signal that management is creating more positive value for shareholders. By dividing the net income by the shareholders’ equity, we arrive at the ROCE, which is typically expressed as a percentage. Therefore, investors should use ROCE as part of a comprehensive performance evaluation framework and consider other financial and non-financial performance factors.

Organizations that consistently maintain higher ROE than the industry average are often considered healthier and more adept in their financial strategies. An annual calculation of ROCE is standard practice, offering a clear view of yearly performance. For more granular analysis, quarterly calculations can provide insights into shorter-term operational efficiency. Nevertheless, understanding the underlying principles of ROCE calculation remains invaluable for anyone serious about financial analysis. For businesses aspiring to uplift their ROCE, the dual approach of optimizing net income and efficiently managing equity comes into play.

Since equity is equal to assets minus liabilities, increasing liabilities (e.g., taking on more debt financing) is one way to artificially boost ROE without necessarily increasing profitability. This can be amplified if that debt is used to engage in share buybacks, effectively reducing the amount of equity available. Though ROE looks at how much profit a company can generate relative to shareholders’ equity, return on invested capital (ROIC) takes that calculation a couple of steps further. Finally, negative net income and negative shareholders’ equity can create an artificially high ROE.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. As a certified market analyst, I use its state-of-the-art AI automation to recognize and test chart patterns and indicators for reliability and profitability. Embarking on the journey to understand and analyze ROCE is akin to equipping oneself with a critical lens through which the financial efficacies of companies can be discerned. A critical mistake in analyzing ROCE is making direct comparisons across different industries without acknowledging the varying capital structures and operational models.

The total equity of a company also plays a significant role in its return on common stockholders equity. One of the essential metrics for investors to consider is the return on common stockholders equity. Anastasia finds out that for each dollar invested, the company ABC returns revolving credit facility 29.2% of its net income to the common stockholders. Compared to the industry average of 22.4%, the company ABC is a safe bet for investing. Anastasia knows that the company has distributed $200,000 in preferred dividends and that the firm’s reported net income is $850,000.

An industry will likely have a lower average ROE if it is highly competitive and requires substantial assets to generate revenues. Industries with relatively few players and where only limited assets are needed to generate revenues may show a higher average ROE. There are times when return on equity can’t be used to evaluate a company’s performance or profitability. However, an extremely high ROE can also be the result of a small equity account compared to net income, which indicates risk. An outsize ROE can be indicative of a number of issues, such as inconsistent profits or excessive debt. In general, both negative and extremely high ROE levels should be considered a warning sign worth investigating.